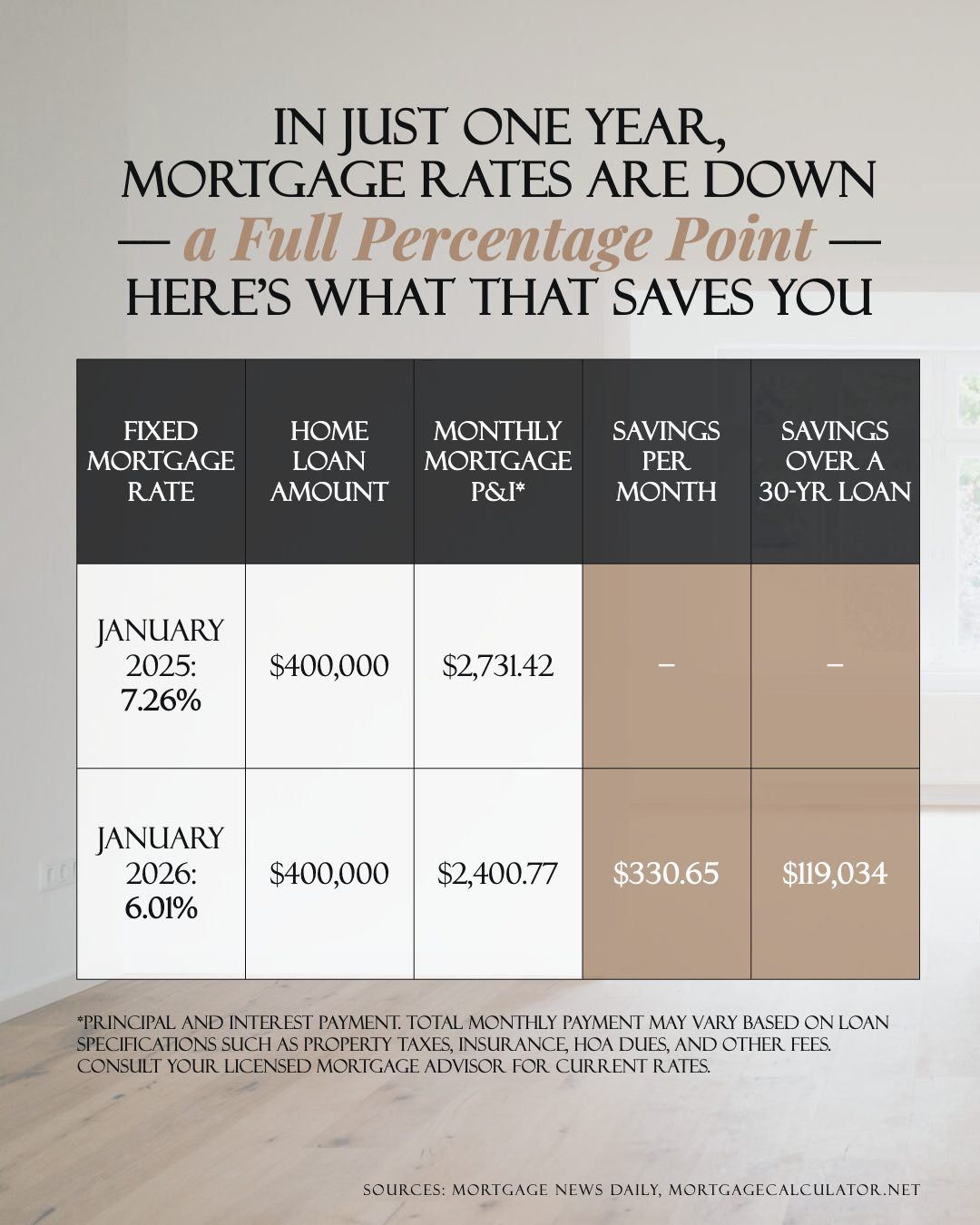

In Just One Year Mortgage Rates are Down a Full Percentage Point

THinking about Selling Your House As-Is? Read This First.

Thinking about Selling Your House As-Is? Read This First.

If you’re thinking about selling your house this year, you may be torn between two options:

- Do you sell it as-is and make it easier on yourself? No repairs. No effort.

- Or do you fix it up a bit first – so it shows well and sells for as much as possible?

In 2026, that decision matters more than it used to. Here’s what you need to know.

More Competition Means Your Home’s Condition Is More Important Again

Over the past year, the number of homes for sale has been climbing. And this year, a Realtor.com forecast says it could go up another 8.9%. That matters. As buyers gain more options, they also re-gain the ability to be selective. So, the details are starting to count again.

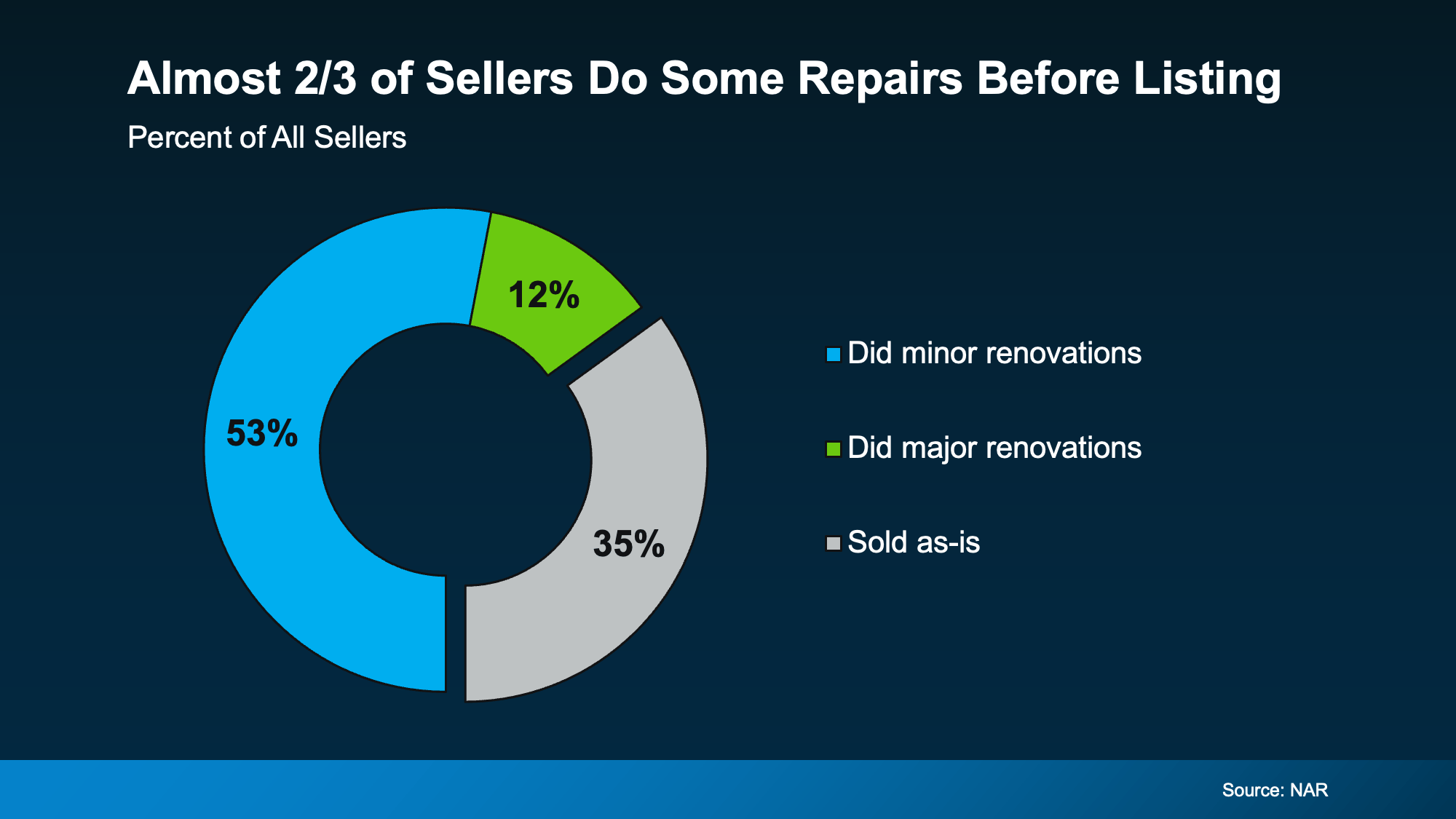

That’s one reason most sellers choose to make some updates before listing.

According to a recent study from the National Association of Realtors (NAR), two-thirds of sellers (65%) completed minor repairs or improvements before selling (the blue and the green in the chart below). And only one-third (35%) sold as-is:

What Selling As-Is Really Means

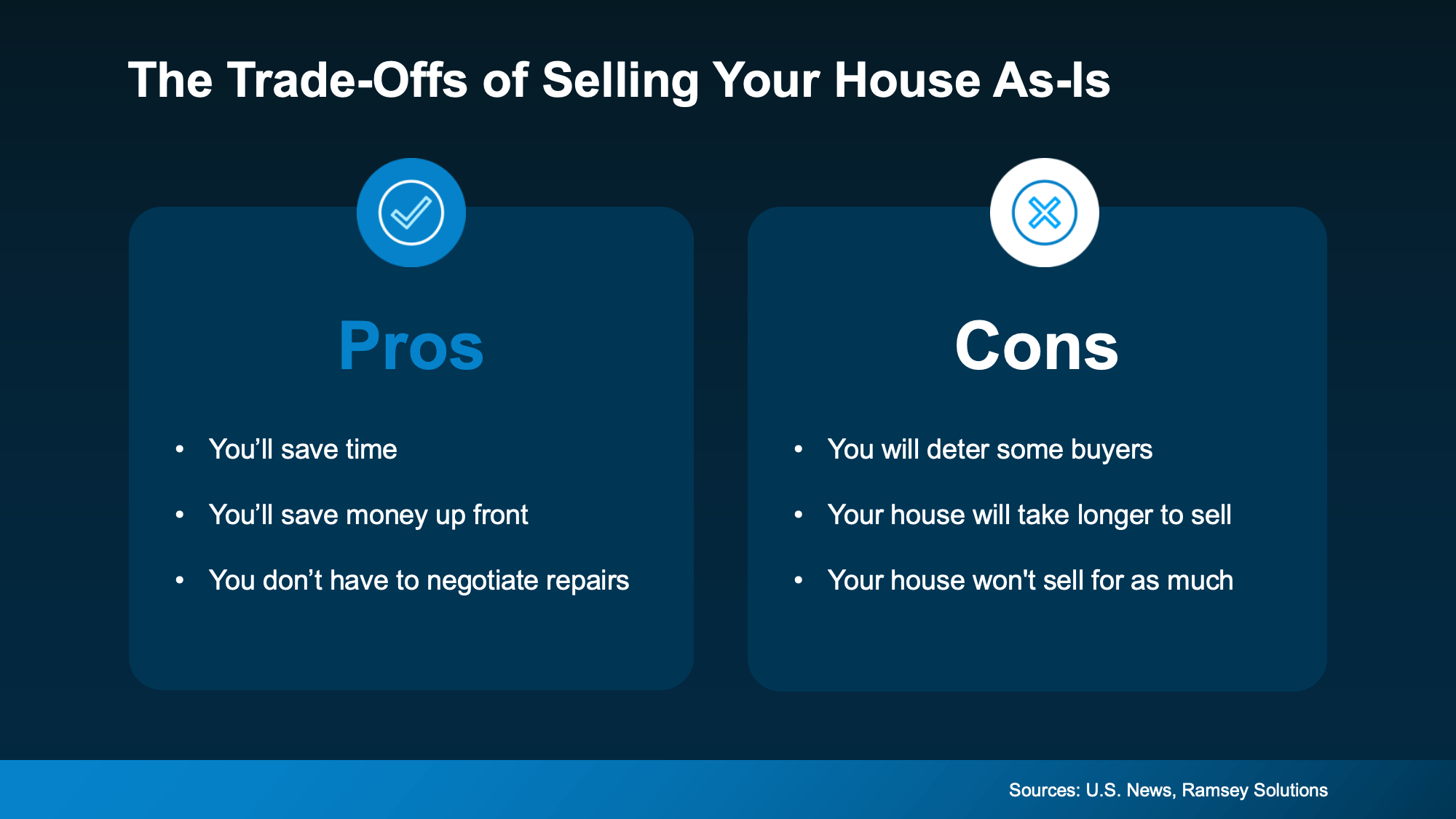

Selling as-is means you’re signaling upfront that you won’t handle repairs before listing or negotiate fixes after inspection. That can definitely simplify things on your end, but it also narrows your buyer pool.

Homes that are move-in ready typically attract more buyers and stronger offers. On the flip side, when a home needs work, fewer buyers are willing to take it on. That can mean fewer showings, fewer offers, more time on the market, and often a lower final price.

It doesn’t mean your house won’t sell – it just means it may not sell for as much as it could have.

How an Agent Can Help

How an Agent Can Help

So, what should you do? The answer isn’t one-size-fits-all. It’s going to depend a lot on your house and your local market.

And that’s why working with an agent is a must. The right agent will help you weigh your options and anticipate what your house may sell for either way – and that can be a key factor in your final decision.

- If you choose to sell as-is: They’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just the projects.

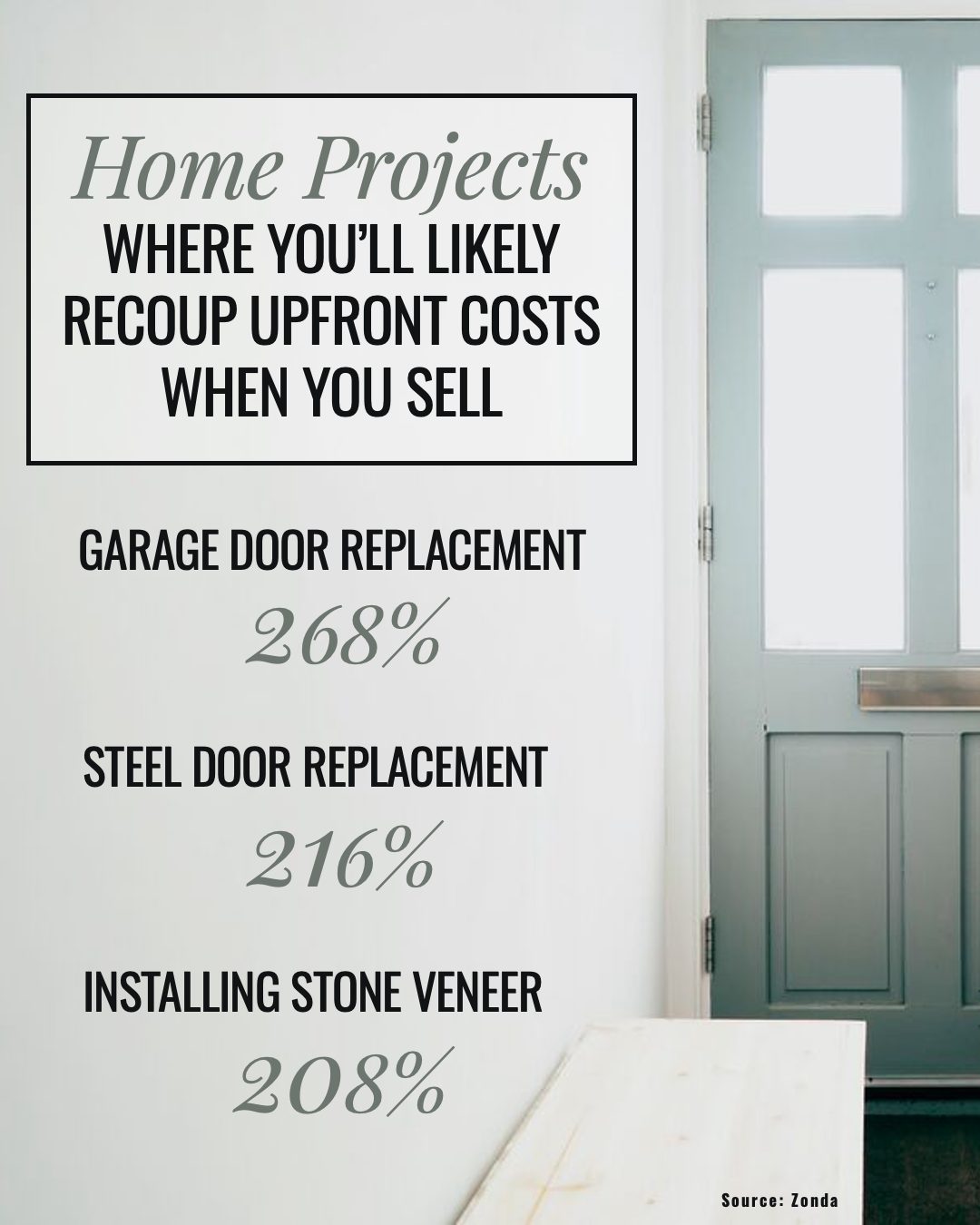

- If you decide to make repairs: Your agent can pinpoint what’s really worth the time and effort based on your budget and what buyers care about the most.

The good news is, there’s still time to get repairs done. Typically speaking, the spring is the peak homebuying season, so there are still several months left before buyer demand will be at its seasonal high. That means you have time to make some repairs, without rushing or stressing, and still hit the listing sweet spot.

The choice is yours. No matter what you end up picking, your agent will market your house to draw in as many buyers as possible. And in today’s market, that expertise is going to be worth it.

Bottom Line

While selling as-is can still make sense in certain situations, in some markets today, it may cost you. So, no, you don’t have to make repairs before you list. But you may want to.

To make sure you’re considering all your options and making the best choice possible, let’s have a quick conversation about your house.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

How an Agent Can Help

How an Agent Can Help