Most Experts Are Not Worried About a Recession

Most Experts Are Not Worried About a Recession

Homebuyers are watching the economy closely, and for good reason. Buying a home is one of the biggest purchases most people ever make. And some recession talk in the media has made a lot of would-be buyers second guess their plans.

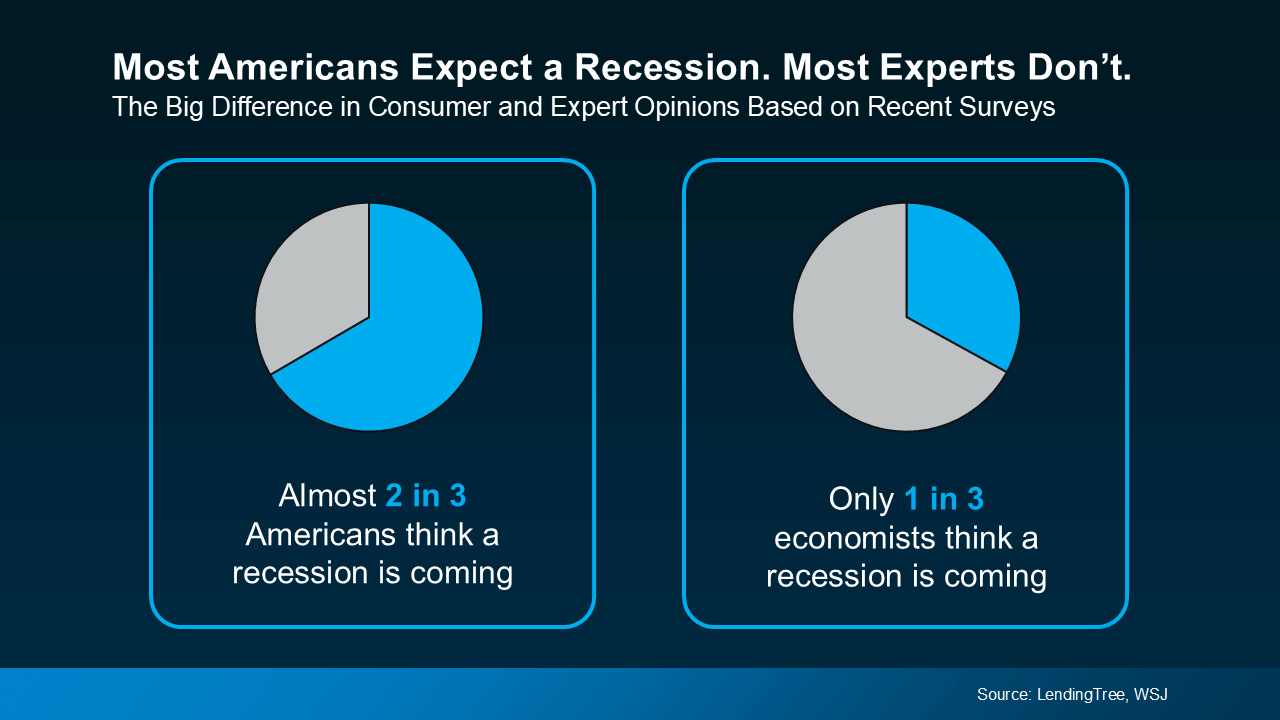

In the latest LendingTree survey, almost 2 in 3 Americans said they think a recession is coming. And 74% of respondents say that’s having an impact on their financial decisions.

But here’s the good news: the experts aren’t nearly as concerned.

Most Americans Expect a Recession, But Most Experts Don’t

According to an October report from the Wall Street Journal (WSJ), only 1 in 3 experts surveyed say we may be headed for a recession sometime in the next 12 months (see graph below):

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

What we do have is uncertainty – and the best way to handle that is by leaning on facts, not fear. You can do that by making sure you have the information you need to make an informed decision.

Tips for Buying a Home During Periods of Economic Uncertainty

Here’s the best advice anyone can give right now. While it’s important to keep an eye on what’s happening in the economy, that shouldn’t necessarily overshadow your real-life needs. Economic shifts come and go, but the reasons people buy homes rarely change. Danielle Hale, Chief Economist at Realtor.com, explains:

“Well-prepared buyers who have been waiting on the sidelines are likely motivated by personal and lifestyle needs like growing families, new jobs, or retirement. And these considerations can outweigh short-term economic uncertainties . . . ”

Timing your move around real life (not the news cycle) is what matters most.

But here’s the key. If you’re going to buy a home right now, job stability really matters. You need to feel confident in your income and know you can comfortably manage your mortgage payments, even if your situation or the economy shift.

If your job is secure and you’ve built a cushion of savings, experts say you don’t necessarily need to delay. Just keep these tips from the economists at Redfin in mind:

- Set a budget and stick to it: Don’t overextend. Make sure your payments are affordable and your savings can cover any surprises. This includes factoring in costs likely to rise, like home insurance and taxes.

- Negotiate: There are more homes for sale right now, and other buyers may pull back because of their own fears. That gives you more negotiating power when working with sellers. Use it to get the best deal possible.

- Be strategic about payments and mortgage rates: Talk to lenders about what payment you can afford and the rate you can qualify for today, as well as your options if rates go down later on.

- Consider selling before you buy: If you already own a home, selling first can reduce the financial pressure and help solidify your budget for your next home.

But nothing replaces the value of having a trusted team around you, especially right now. As Bankrate says:

“Buying a home during a recession can sometimes be a good idea – but only for people who are lucky enough to remain financially stable . . . Be sure to enlist the help of an experienced local real estate agent. Not only do agents know their markets well, they will also work to get you the best deal in any given situation, including a recession.”

Bottom Line

Most Americans think a recession is coming. But most experts don’t.

So, you don’t necessarily have to put your moving plans on hold. If your finances are solid, your job is stable, and you have a real need to move, you can still make it happen.

What’s holding you back from making your next move? Let’s talk it over.

The Top 2 Things Homeowners Need To Know Before Selling

The Top 2 Things Homeowners Need To Know Before Selling

Here’s something you should know before you sell your house. The homeowners who win in today’s market aren’t the ones waiting it out or stepping back. They’re the ones who adapt from the start.

A number of homeowners this year didn’t get the outcome they wanted. But it’s not because something’s wrong with the market. It’s because something wasn’t right with their expectations.

Realtor.com reports 57% more homes have been taken off the market compared to last year. That means they listed… but didn’t sell. But here’s the honest truth. It was mostly because of two things: price and timing.

And if the seller had come in with the right mindset on each, their sale would’ve gone differently. Here are the top 2 things you can learn from those other sellers.

1. Price It Right from Day 1

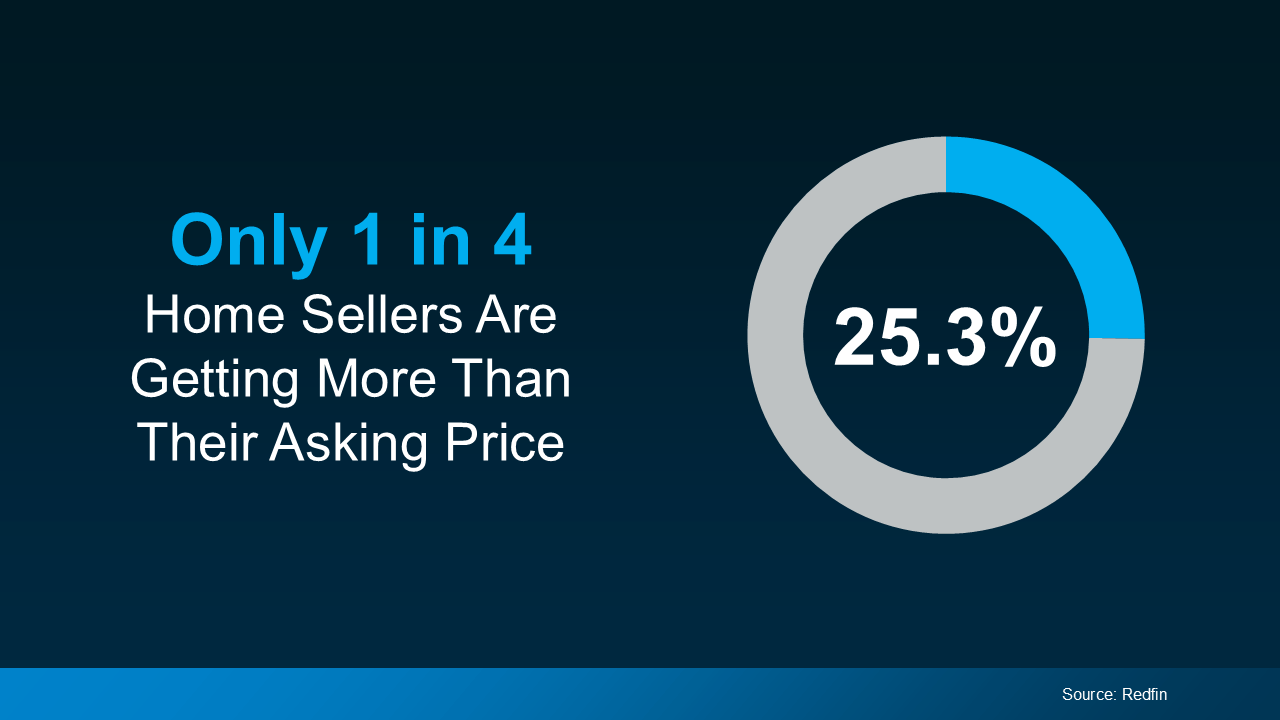

Let’s start with the most common sticking point: the asking price. Today, 8 in 10 sellers expect to get their asking price or more. But that confidence doesn’t always line up with reality.

According to Redfin, only 1 in 4 (25.3%) sellers are actually getting more than their list price.

And here’s where the mismatch is coming from.

And here’s where the mismatch is coming from.

A few years ago, you could set any price and buyers would come running, no matter what the price tag said. Odds are, you’d still sell for over asking. But things are different now.

Buyers have more options than they’ve had in years, so they can afford to be more selective. If your price feels even a little high to them, it’ll get overlooked in a heartbeat.

And for the homeowners who had that happen, some end up pulling their listings instead of making a simple adjustment that could have changed everything. Which is a shame, honestly. Because a small price tweak is usually all it takes to bring buyers in and get the deal done.

According to HousingWire, the average price cut right now is just 4%.

Think about that. Other sellers are listing too high and giving up rather than dropping their price 4%. If they’d just started 4% lower, they may have already sold. So, before you list, talk to your agent about what’s working nearby. They’ll help you find the sweet spot that’s competitive, realistic, and still protecting your bottom line.

And here’s the kicker. If you’ve been in your home for a while, your equity gives you room to set your list price more competitively and still come out way ahead. Unfortunately, those other sellers didn’t seem to realize that.

2. Don’t Rush the Process

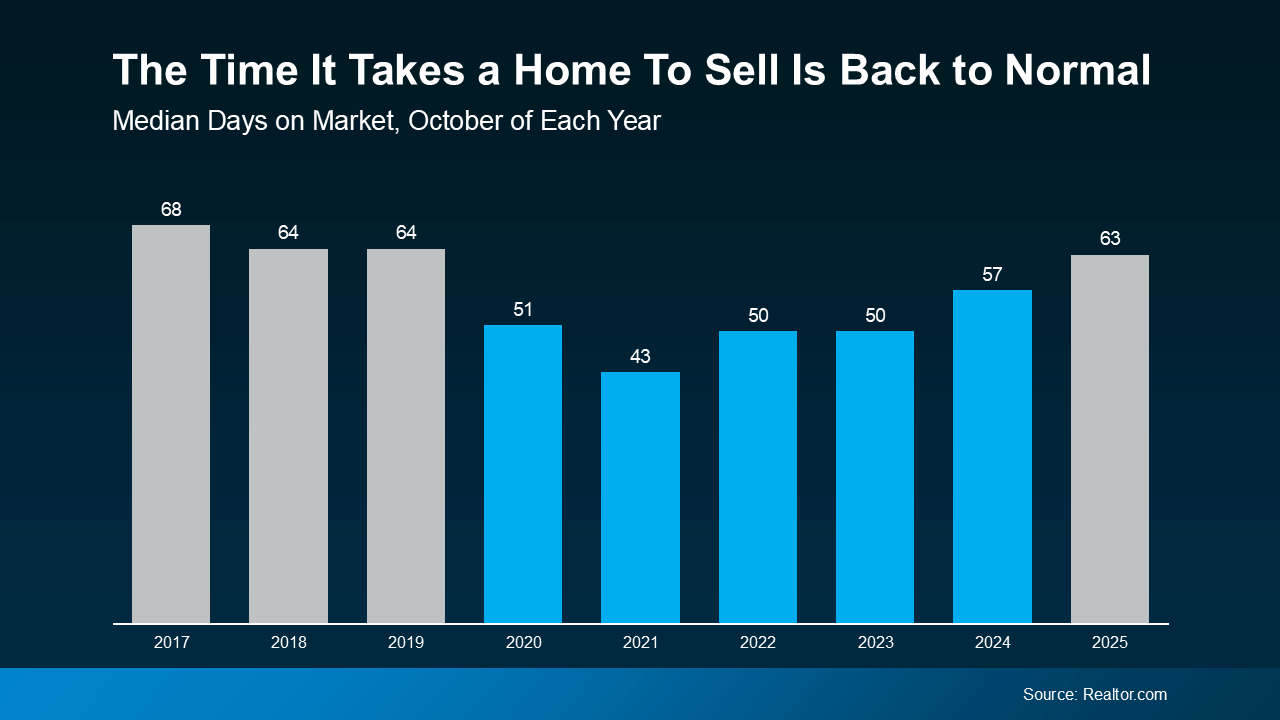

Another common misstep: expecting your house to sell in a weekend.

Many sellers right now remember when homes sold in as little as hours – and they expect that to happen today. But in most markets, that’s not the reality anymore.

It takes closer to 60 days to go from listed to sold, which is actually normal (see the gray in the graph below):

It just feels slower because they’re comparing it to the lightning-fast pace of 2020 and 2021.

It just feels slower because they’re comparing it to the lightning-fast pace of 2020 and 2021.

Think of it like driving 65 mph on the highway, then exiting and going 25. It feels like you’re crawling, but it’s actually the right speed for where you are. That’s what other sellers can’t seem to get over. But you can get ahead of that, by knowing what to expect.

Today’s buyers are more intentional. They’re taking their time, weighing their options, and making thoughtful decisions, which is creating a much healthier housing market.

So, if you’re planning to sell, don’t expect it to happen instantly. And don’t assume your house won’t sell if it doesn’t go under contract in the first weekend.

It’s normal for these things to take time.

If you want to make sure your house sells as quickly as possible, talk to your agent about ways to stand out, whether that’s through staging, photography, or strategic pricing. With the right advice, the right price, and the right prep work, it can still sell quickly.

Bottom Line

If you’re thinking about selling, don’t let the market discourage you, let it guide you. The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You can still win if you price right, are patient, and work with a local agent who knows how to position your home from the start.

Because in today’s market, success isn’t about waiting for conditions to change. It’s about getting your expectations right from day one.

The Housing Market Is Turning a Corner Going into 2026

The Housing Market Is Turning a Corner Going into 2026

After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever, there’s movement happening again.

No, it’s not a surge. But it is a shift – and it’s one that could set the stage for a stronger year in 2026.

So, what’s driving the comeback? Here are three big trends that are slowly breathing life back into the housing market right now.

1. Mortgage Rates Have Been Coming Down

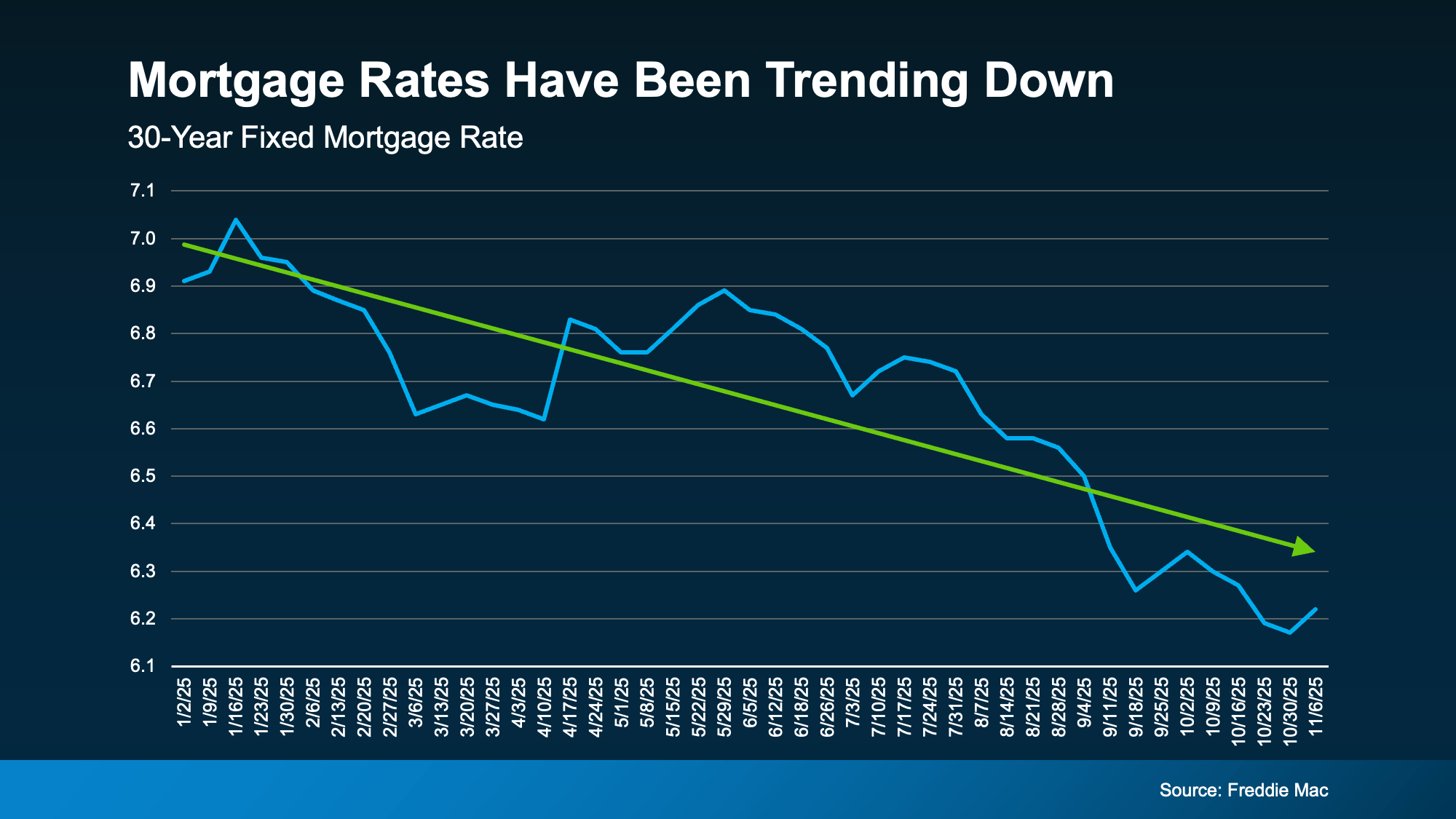

Mortgage rates are always going to have their ups and downs – that’s just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Here’s why that matters for you. This shift changes what you can actually afford. It means lower borrowing costs and more buying power. Take this as an example.

Data from Redfin shows a buyer with a $3,000 monthly budget can now afford roughly $25,000 more home than they could one year ago. That’s a big deal. And it’s just one of the reasons why activity is picking up.

2. More Homeowners Are Ready To Sell

For a while, many homeowners stayed put because they didn’t want to give up their low mortgage rate. That “lock-in effect” kept inventory tight. And while plenty of homeowners are still staying where they are today, the number of rate-locked homeowners is starting to ease as rates come down. Life changes are becoming a bigger part of what’s driving more people to move, and that’s opening up more inventory.

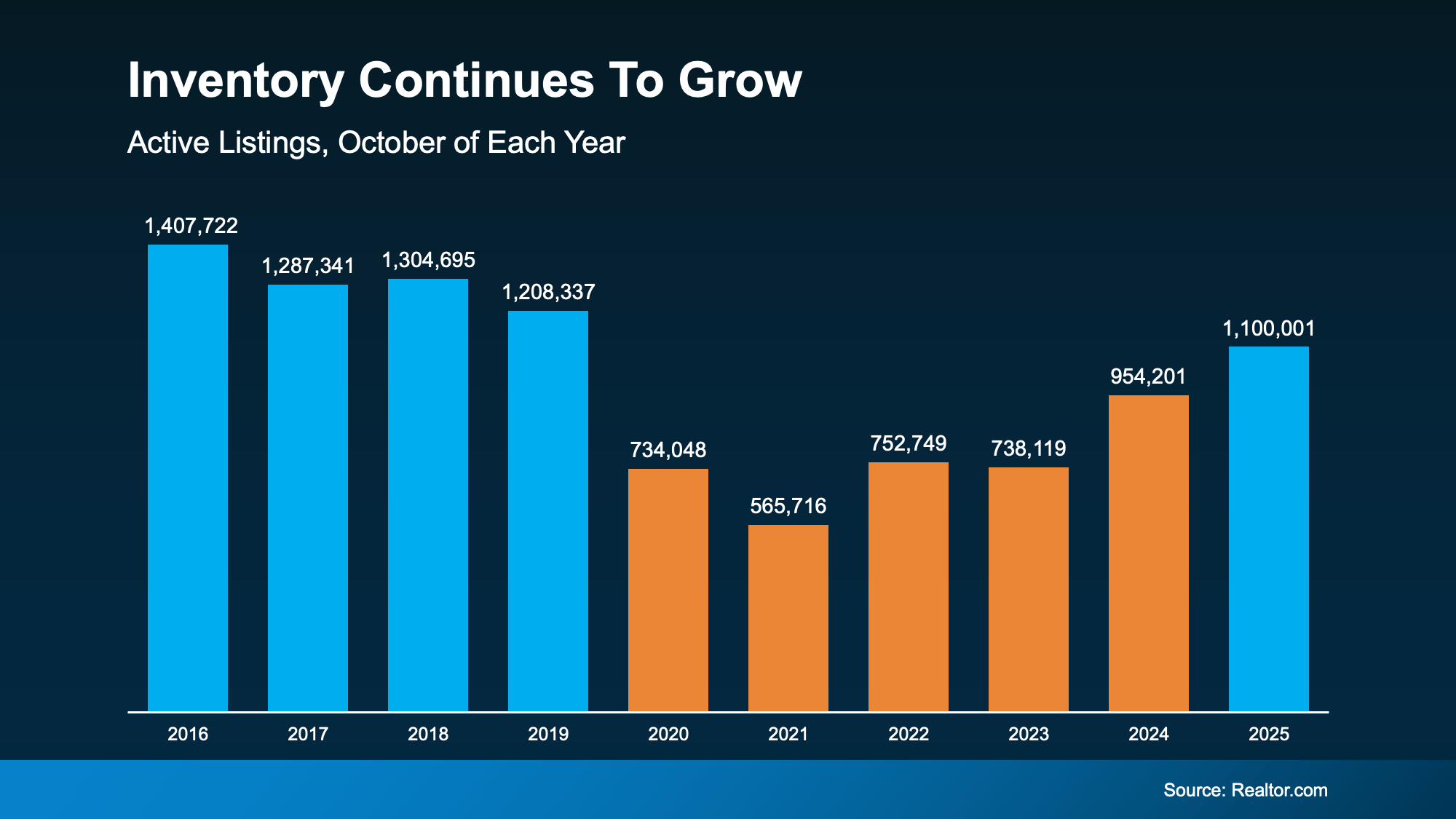

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

3. More Buyers Are Re-Entering the Market

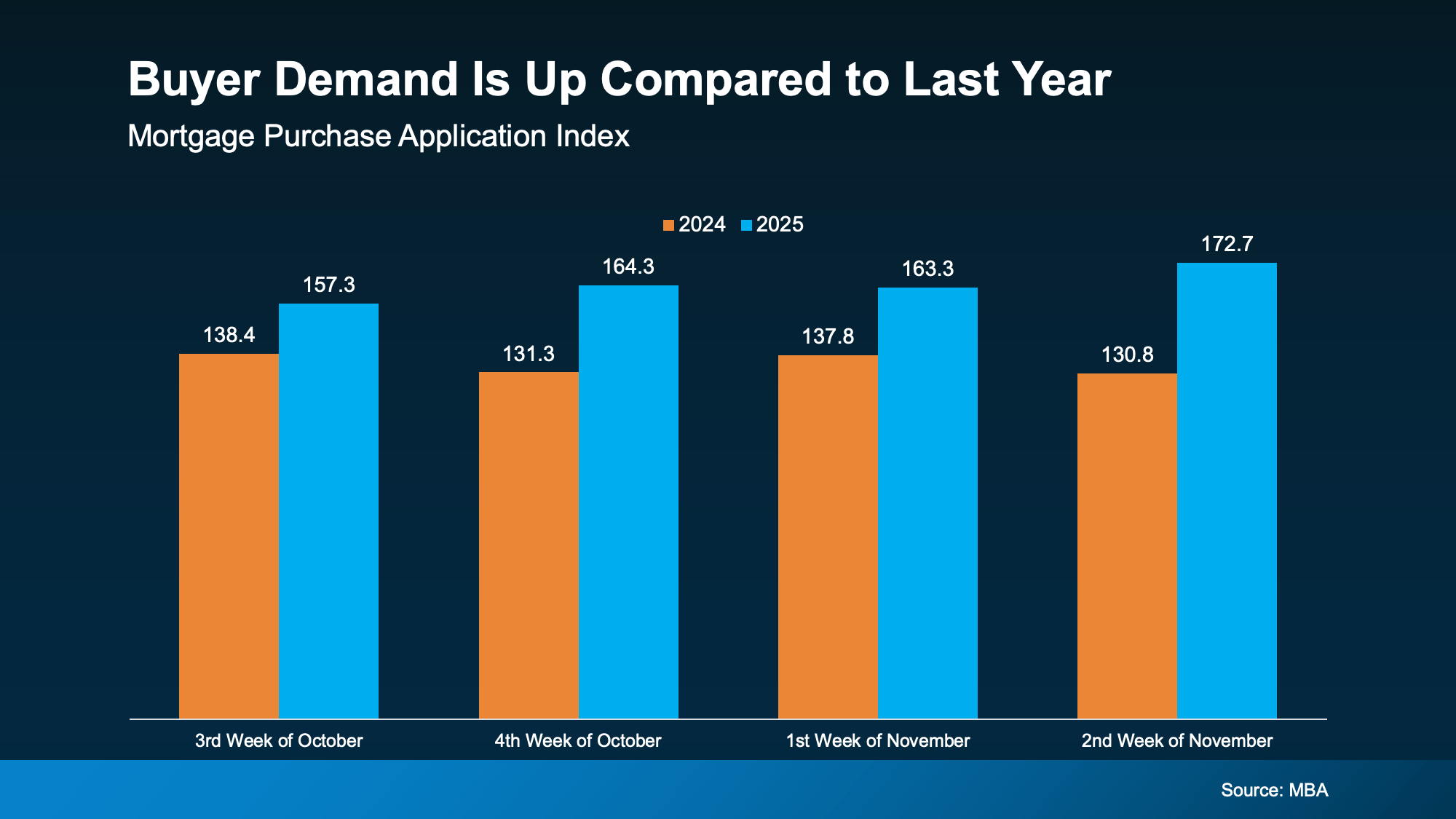

And it’s not just sellers making moves. With more options and slightly better affordability, buyers are getting back in the game, too. The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

Now, this recovery won’t happen overnight. It’s not a flood of activity. But it is the start of steady improvement going into 2026. And that’s something a lot of people have been waiting for.

Bottom Line

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

Let’s connect to talk about what’s happening in our local market and how you can make the most of it in 2026.

Waiting for Rates to Fall Below 6% May Save you Only $80 a Month

Are Builders Overbuilding Again? Let’s Look at the Facts.

Are Builders Overbuilding Again? Let’s Look at the Facts.

If it feels like you’re seeing new construction signs pop up everywhere, you’re not wrong. Builders have been busy. And it’s left some people wondering: Are we overbuilding like we did right before the 2008 housing crash?

No matter what you may hear in the news, there’s no reason for alarm. In reality, data shows builders aren’t racing ahead, they’re actually starting to tap the brakes.

Builders Are Pulling Back, Not Piling On

Permits (applications to start building new homes) are one of the best early indicators for what’s next for home construction. And right now, building permits are trending down, not up. Here’s why that’s so important.

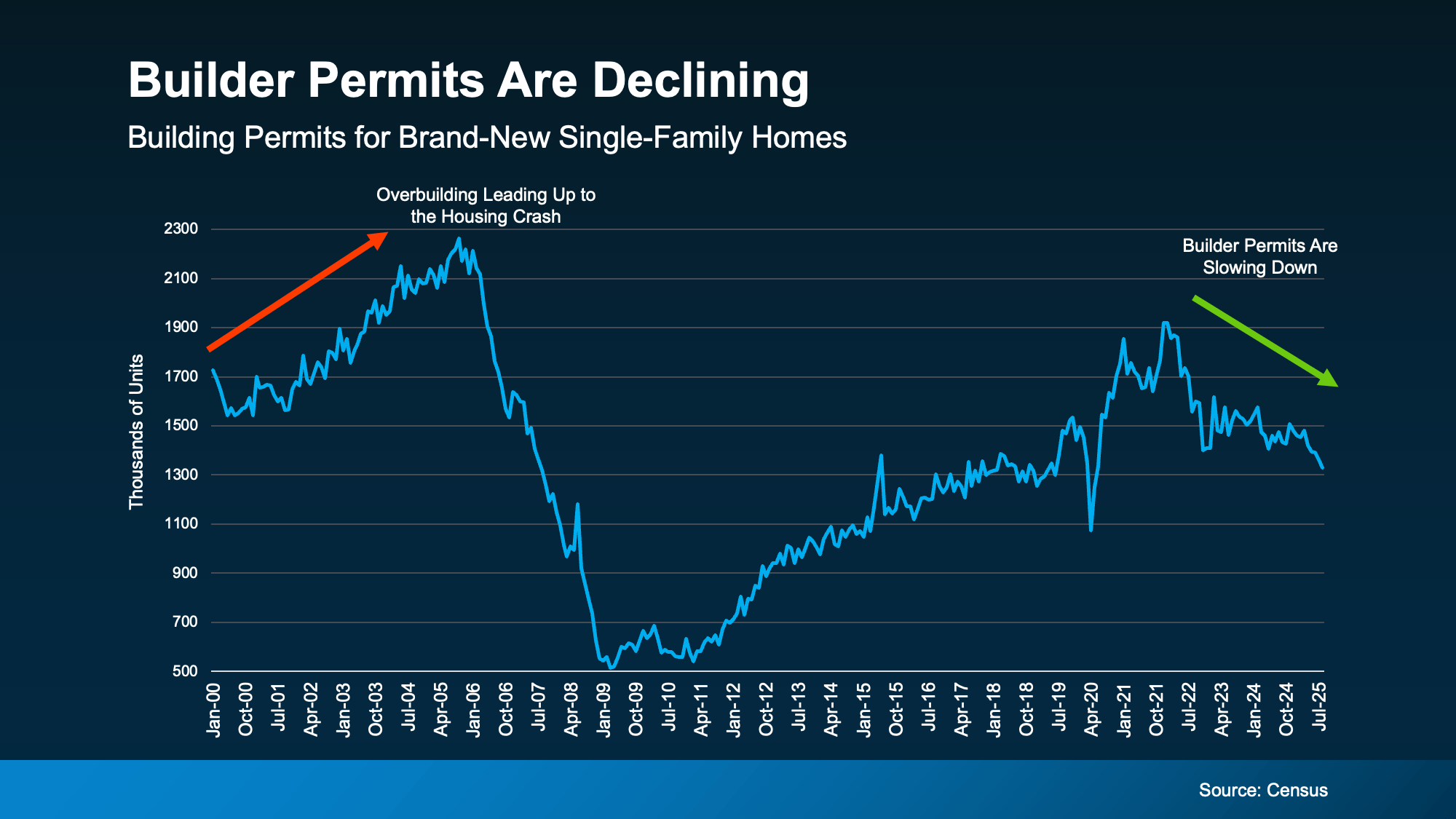

In the years before the housing crash of 2008, builders really ramped up their production of single-family homes (the red arrow in the graph below). And unfortunately, they built far more homes than the market actually needed. That oversupply led to falling home prices. That’s what so many people remember, and what they worry will happen again.

But while construction has been picking back up since roughly 2012, we’re not headed for a repeat of the same mistakes. The latest data available shows builders are actually starting construction on fewer homes right now (the green arrow in the graph below):

New data from the National Association of Home Builders (NAHB) confirms that trend. It shows that single-family building permits have fallen for eight straight months.

New data from the National Association of Home Builders (NAHB) confirms that trend. It shows that single-family building permits have fallen for eight straight months.

The Slowdown Isn’t Random, It’s Intentional

Basically, builders are watching and reacting to today’s economic conditions and buyer demand in real time. And they’re pumping the brakes on their pipelines to avoid getting caught with too much unsold inventory. As Ali Wolf, Chief Economist at Zonda, says:

“. . . builders are still working through their backlog of inventory but are more cautious with new starts.”

That’s a big contrast to what happened before the housing crash, when overconfidence led to record-breaking levels of new home construction – even as demand was dropping. Today’s builders aren’t overconfident. They’re listening to the market and adjusting before things get out of balance.

The Regional Picture Tells the Same Story

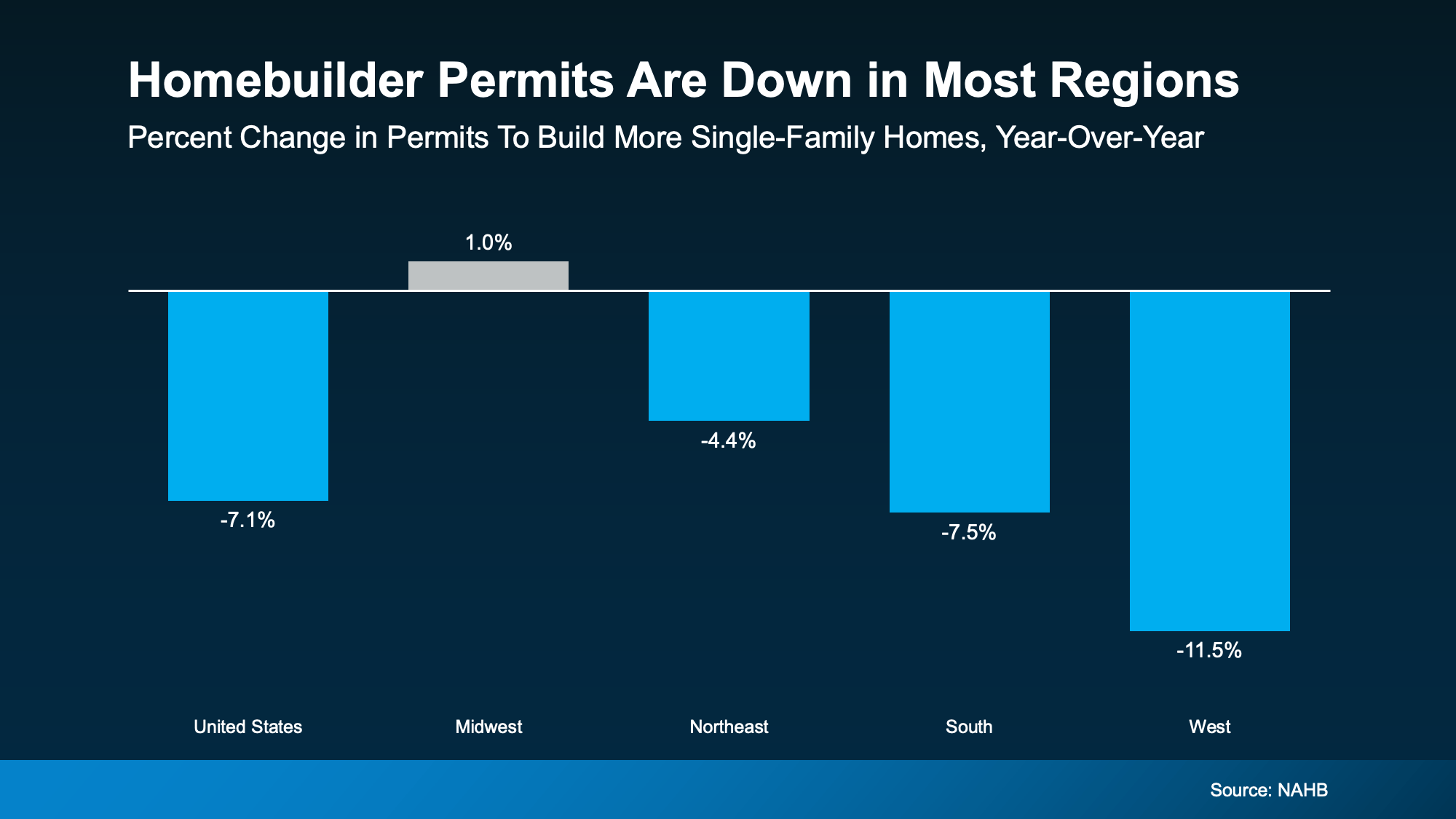

And while inventory is going to vary a lot based on where you live, if you zoom out and look at regional data, the pattern holds almost everywhere (see graph below):

NAHB reports single-family permits are down in nearly every part of the country, with just one region showing a slight uptick. And even there, the growth is so small, it’s practically flat.

NAHB reports single-family permits are down in nearly every part of the country, with just one region showing a slight uptick. And even there, the growth is so small, it’s practically flat.

Why This Isn’t 2008 All Over Again

In the lead up to the crash, builders kept building long after demand had disappeared. This time, they’re slowing down early, and that’s a good thing.

The market actually needs more homes after years of underbuilding. But builders are making sure they don’t have to overcorrect. They’re being intentional about how many homes they’re building right now.

So yes, you’re seeing more new homes for sale today, but that doesn’t mean we’re oversupplied nationally. It means buyers finally have more options, and builders are pacing themselves to keep things in check. They’re not going to flood the market. And that’s a really good thing for housing overall.

Bottom Line

Seeing more new homes for sale doesn’t mean builders are overdoing it. Since building permits have been declining for eight straight months, it’s clear this isn’t an out-of-control boom. It’s a measured recovery.

If you want to know more about what builders are doing in our area, let’s connect.

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there. The chance to buy a home without having a down payment.

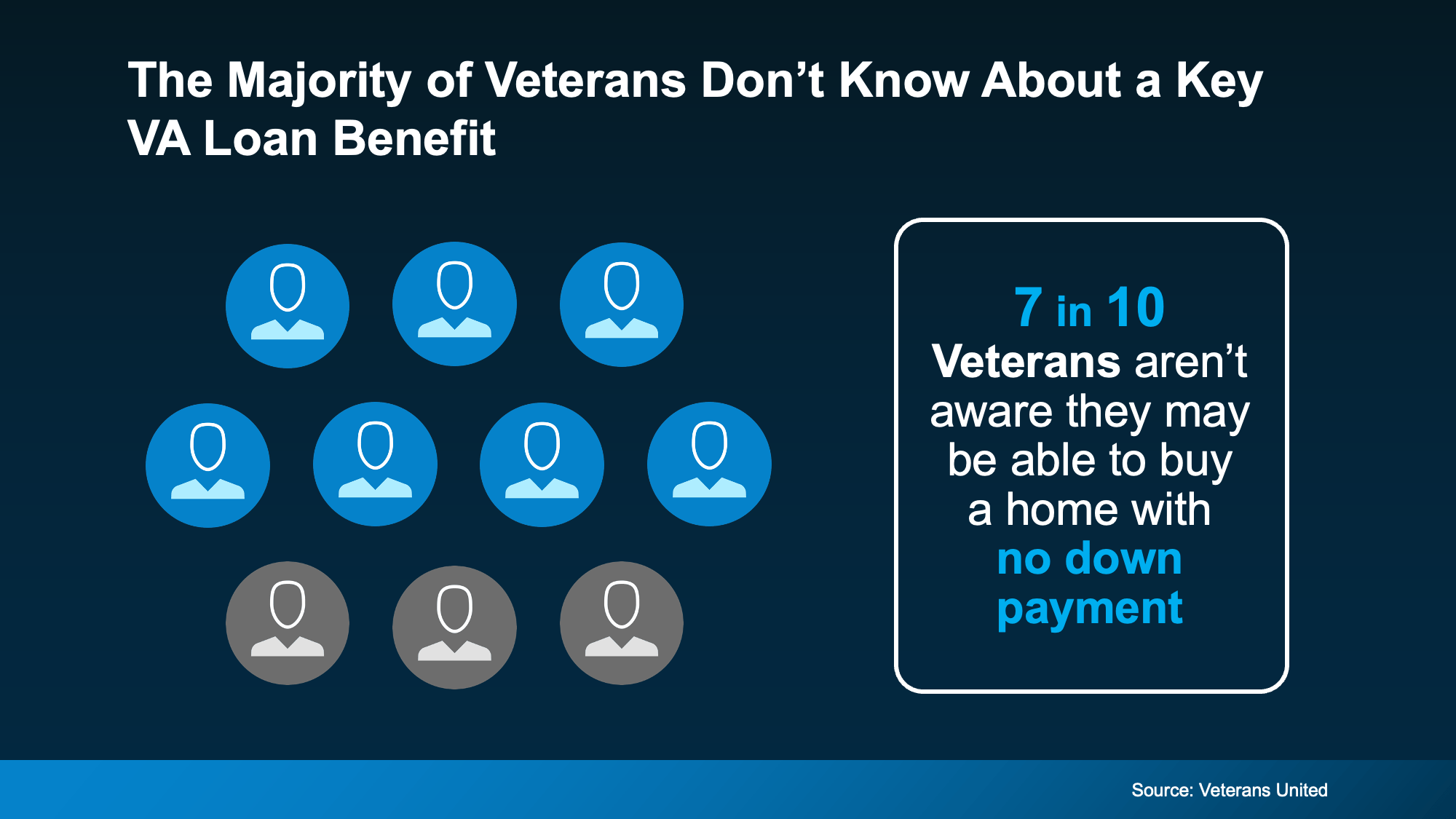

Unfortunately, 70% of Veterans (that’s 7 out of every 10) don’t know about this benefit, according to Veterans United.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

Why VA Home Loans Can Be a Great Option

For nearly 80 years, VA loans have made homeownership possible for millions of Veterans and active-duty service members. Here are just a few of the top perks according to the Department of Veteran Affairs:

- Options for $0 Down Payment: Many Veterans can buy a home without spending years saving up.

- Fewer Upfront Costs: The VA limits which types of closing costs Veterans have to pay, helping you keep more cash on hand when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, lowering your monthly costs.

These features make VA loans a great way for service members (or their family) to build stability, save money, and start creating long-term wealth through homeownership.

Can You Still Get a VA Loan with the Government Shutdown?

But lately, there’s been some confusion about whether VA loans are still available due to the government shutdown. And that uncertainty has kept some Veterans from taking the next step.

While there may be processing delays, Veterans United explains you can still get a loan:

“There’s been a lot of confusion and uncertainty about how a government shutdown will affect VA home loans . . . The good news is that the shutdown has minimal impacts on VA lending. Lenders are still able to order appraisals, obtain a borrower’s Certificate of Eligibility, submit the VA Funding Fee and more. In short, Veterans are still able to use their home loan benefit to buy a home or refinance an existing mortgage.”

So, despite the headlines, you can still use your VA home loan benefits today. The process is ready when you are. It just may take more time to go through.

Why the Right Agent and Lender Matter

Just remember, using your VA home loan is easier (and smoother) when you have the right team behind you. As VA News puts it:

“Choosing a military-friendly broker or agent who understands the VA home loan application process can make all the difference in the homebuying experience. Finding the right agency or brokerage is just as important as locking in a good VA mortgage lender. Communication is key to getting to the loan closing table.”

A knowledgeable agent and an experienced lender can help you navigate every step, all the way from qualifying to closing. With their help, you can make sure you’re getting the most out of your benefits.

Bottom Line

If you’re a Veteran, a VA home loan is one of the most valuable benefits you’ve earned through your service. It offers options for no down payment, limited closing costs, and more.

Want to learn more? Talk to a lender so you can take full advantage of the benefits you’ve earned.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link